We’ve been hard at work in the past few months designing and implementing Zircon, the evolution of the decentralized exchange model. We’ve designed a new protocol that seeks to fix the biggest issues that have plagued existing automated market maker platforms and prevented potential new entrants from dipping their toes.

Zircon is a risk separation or tranching solution, creating high-risk and low-risk shares out of a regular AMM pool. This enables a whole new dynamic to supplying assets into AMMs, one that makes a lot more sense than whatever existed before.

We’ve chosen to get back to the roots of what made AMMs popular: a simple and passive way to earn some additional yield. This is in partial contrast to the direction chosen by others, who want to optimize their bonding curves to allow larger size trades for the same amount of liquidity.

These solutions are usually presented as more capital efficient, but from the perspective of the regular liquidity provider, they’re anything but. With concentrated bonding curves, LPs need to actively manage their liquidity to remain competitive. This means that these AMMs become the territory of bots and hedge funds, just like order book exchanges. We think capital efficiency is a poor goal to pursue for AMMs, for one because order books are by far the most capital efficient way of supplying liquidity!

We’re convinced that what makes AMMs cool is that everyone can support liquidity for their favorite assets and earn fees, without any special knowledge. But there are always compromises you need to make, and the worst one is the fact that you’re always exposed to more than one asset.

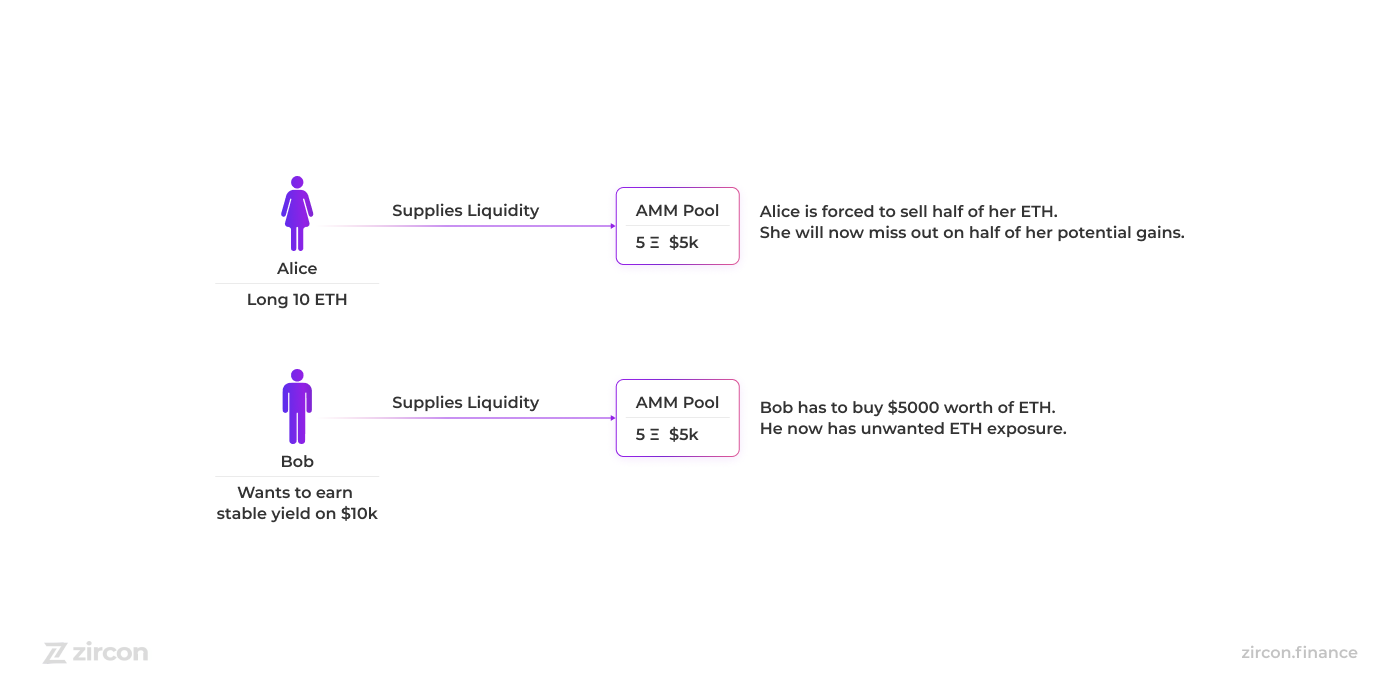

Let’s use an example. If you’re Alice and you’re bullish on ETH, putting it in an ETH/USD pool is really a suboptimal choice. You’d need to split it up 50:50 with USD, losing over 50% of your potential gains just to gain those swap fees.

At the same time, there will always be a Bob who just wants to stay safe and earn some yield on his dollars without caring what the market is doing. But he too can’t use the ETH/USD pool, as he’d need to split his capital 50:50 with ETH and get that unwanted exposure.

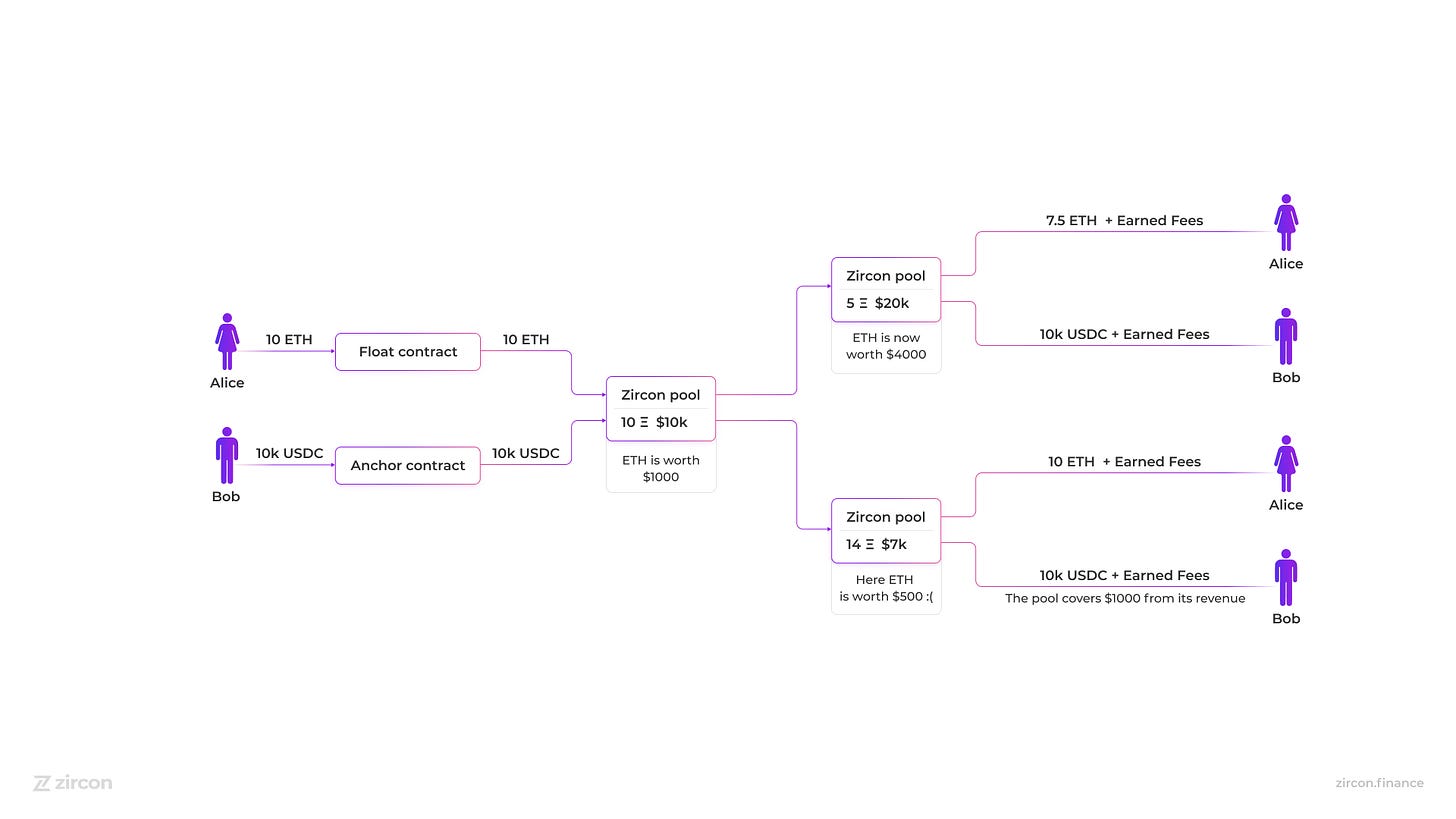

That’s where Zircon comes in. We just join Alice and Bob together, so that combined they provide the required 50:50 balance of assets, but each gets to keep 100% of their desired portfolio.

How does that work?

Zircon allows Alice and Bob to enter into an automated social pact. The pact says that Bob only ever gets to withdraw whatever dollars he put in, plus the fees. Alice gets to benefit from the entirety of the pool’s rise in value (and of course the fees for her share of liquidity).

The flipside is that Alice compensates Bob if the pool loses in value. Bob must be able to withdraw all of his dollars, after all. This promise is also backed by the pool’s income, which covers the small portion of Bob’s share that isn’t compensated by Alice.

Bob is the risk-averse liquidity provider, and he’s willing to give up gains if it also reduces his potential losses. We call him the Anchor, but in TradFi land he’d be called the Senior Tranche.

Alice is the risk-taker here. She doesn’t care if her ETH loses in value, as long as she keeps her upside potential. For us, she’s the Float, or Junior Tranche in TradFi terms.

Every liquidity pool in Zircon has a Float and an Anchor side. Anchors can be any USD stablecoin, but also popular bases like BTC, ETH, DOT, whatever you want. Floats can be any volatile coin.

What does this change for Zircon users?

Decentralized exchanges are nothing without liquidity providers. But they’re also nothing without the traders. And by sweetening the deal for liquidity providers, we can also do so for traders!

Zircon is set up to be the most liquid and the cheapest market for every volatile crypto asset out there.

We plan to have a maximum of 0.15% fees for any pair, and we will focus on providing direct liquidity for pairs with stablecoins, so traders won’t need to take one swap for the price of two.

This is the main value proposition of Zircon. Much more is still to be revealed, though you can catch a glimpse on our website and litepaper ;)

Sold, how and where do I use Zircon?

Zircon will launch on Moonbeam in the next few months. We aim to release our beta core contracts on testnet in just a couple of weeks and offer them up for community feedback and testing. After that, once we’re confident in launching, you’ll be able to provide liquidity with just one asset into the most popular trading pairs!

If you want to stay updated, subscribe to our newsletter here, sign up for our beta list, and join our Discord and Telegram.

P.S. We’re hiring great developers and marketers. If you wish to contribute to the Zircon project, hit us up at hello@zircon.finance. Right now our priority is a React frontend developer position.

It's one of those rare projects that I truly love and trust. ZICRON

Perfect project🤑