While developing Zircon products we never really got the chance to talk about what will happen after launch, so here it is!

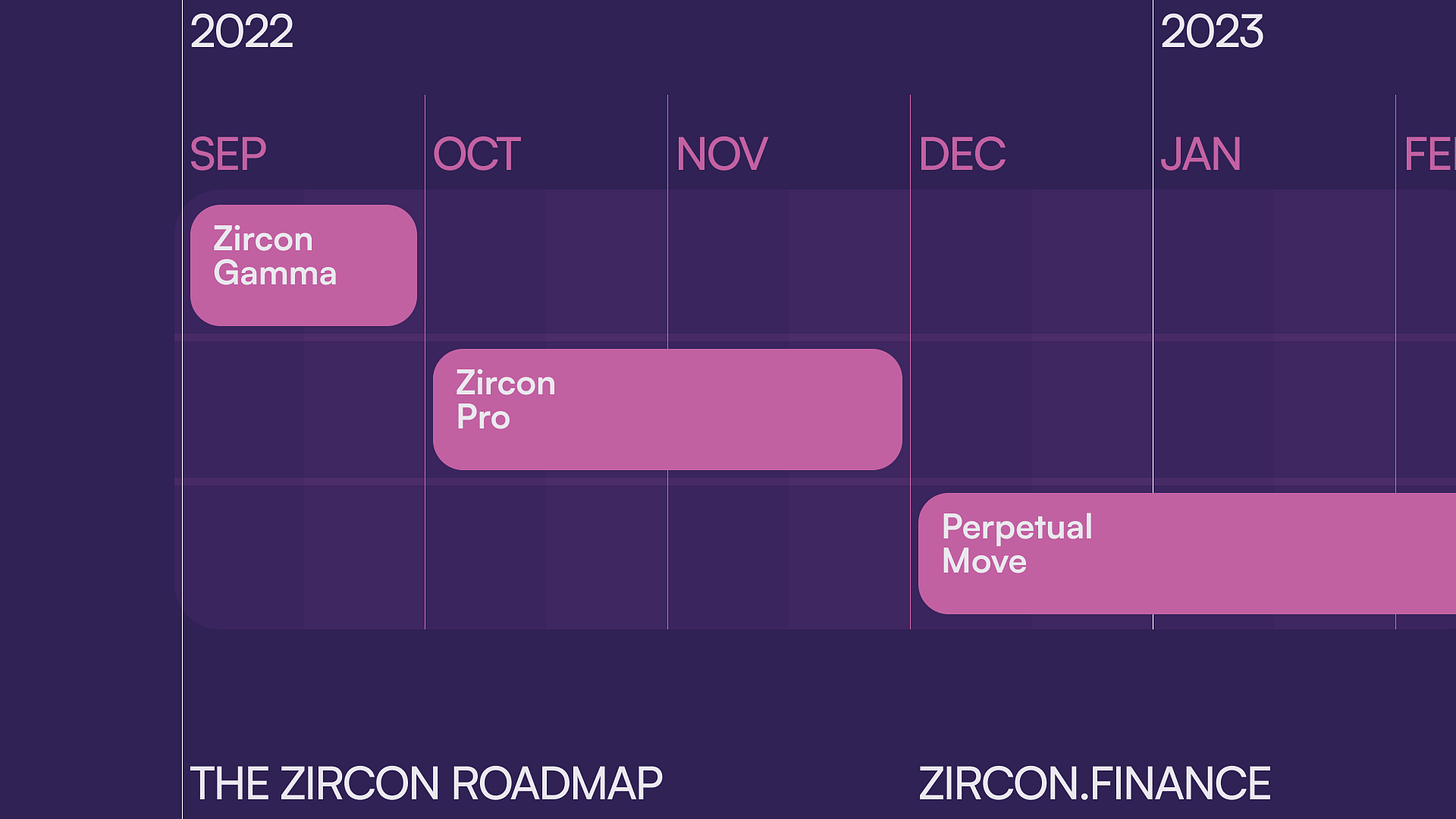

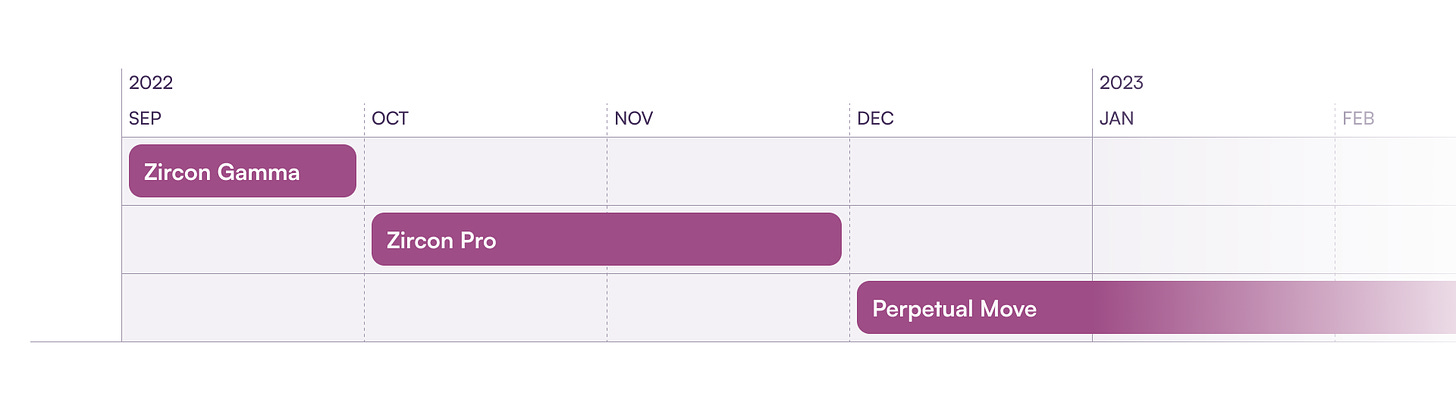

To recap, we’re launching on Moonriver as Zircon Gamma very soon (stay tuned on Twitter for updates). Zircon Gamma is the fair launch, degen-friendly version of Zircon with no insider allocations — except for an initial 5% of supply that is reserved for funding operations.

Then, the fun part begins ✨

🌝Zircon Pro on Moonbeam

Our main product and vision is something we call Zircon Pro: a decentralized exchange built for very active traders and with a CEXy vibe.

What does it mean to build a product for active traders?

It’s a lot of things. It begins with liquidity and efficiency of the trades, but it also includes things like informative UI, powerful automation tools, reliable trade execution (no MEV), and additional features like margin trading support.

Zircon’s goal is simple: create a decentralized exchange that is as convenient as the best centralized platforms.

The road to get there will be long and require many additional features.

To begin that journey, we will launch the main Zircon deployment to Moonbeam. At this stage we aim to begin introducing some of the simpler pro features: rich interface, advanced orders (limit, stop loss).

We expect to execute the deployment at some point in Q4 2022.

🔌Zircon on other chains

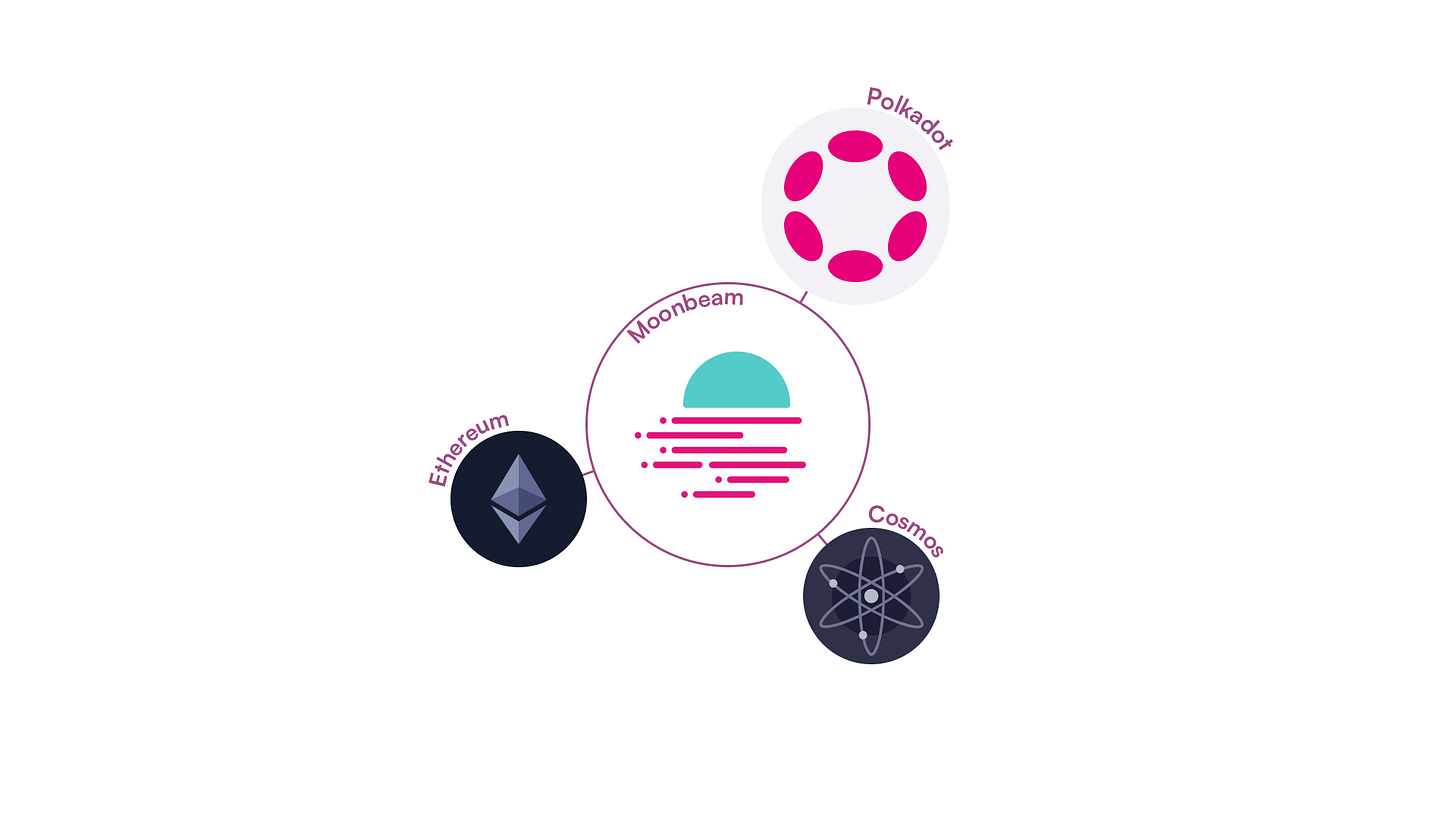

Our home base will be on Moonbeam because we see it as one of the better cross-chain token hubs. Thanks to its integration with Polkadot XCM, Cosmos and the ERC-20 world, it can receive tokens from the largest number of chains and with the highest proportion of non-custodial bridges (Axelar, Interlay BTC to name just a couple).

The combined Moonbeam + Polkadot ecosystem also hosts a number of innovative projects that can become valuable Zircon partners.

But we also aim to expand strategically to other DeFi hubs over time. This includes Ethereum and its L2s, but also Cosmos, Avalanche and other major ecosystems.

Deciding where to expand exactly will depend on the risk/reward calculation: how much DeFi activity does the ecosystem have, and how established are the competitors?

We will of course provide more updates about this when the time comes.

🎡Perpetual Move

Our priority after the main launch is to develop the Perpetual Move, Zircon’s option product for impermanent loss.

This new primitive allows traders to “buy” impermanent loss from Zircon Pylon vaults and make money from it. These traders will pay a significant interest rate to the Zircon liquidity providers, in line with the implied volatility of their assets. (Implied volatility is a unified price for options, which can be arbitraged between different option platforms).

Launching the Perpetual Move will allow us to easily create a lot of liquidity for option trading, and generate enough yield for Zircon Pylon LPs to stop farming rewards.

Developing the Perpetual Move will take some time. We hope to have a proof of concept and beta test up by the end of the year, but most likely we’ll need to wait for the first months of 2023 to see it fully deployed.

🔮Looking into the future

We have many ideas on how to improve Zircon, the DeFi ecosystem and the trading experience in general.

We can’t make specific predictions just yet, but there are two main items we’ll want to focus on in 2023 and beyond.

#1: Zircon V2, The Ultimate AMM

Concentrated liquidity like in Uniswap V3 is the best type of AMM, there’s no doubt about it.

Zircon V2 will feature concentrated liquidity, but optimized for what we believe is the true purpose of AMMs: passively providing liquidity.

For us, concentrated liquidity is much more useful for true Limit Orders. Other DEXs right now that offer limit orders are actually giving you a market order, but triggered at a certain price. This means you still suffer from slippage and front-running.

On Zircon V2, limit orders will be essentially one-way liquidity positions. When this limit order is executed, it’s removed from the pool — it doesn’t get rebalanced back if the price returns to its original spot (unlike currently on Uniswap V3).

Limit orders (when taken) will pay fees to the pool of passive liquidity providers, keeping an even playground. We believe limit order users will already get plenty of utility from having control over the price of their order fill, which can also be used for manual market making.

Regular, two-way concentrated liquidity positions will still be used for options, making Zircon V2 a combined swap + options AMM from the start.

#2 Zircon Chain

The concept of an “App chain”, a dedicated blockchain for a particular app, is becoming popular and for good reason. For large, specialized dApps, generalized blockchains aren’t good enough.

You can’t control UX, you can’t control gas pricing, and the protocol doesn’t earn from them. Because of this, dApp-based DEXs will always be the more expensive and less practical option compared to centralized exchanges.

But a successful Zircon Chain needs a widespread, battle-tested cross-chain transfer ecosystem. We see only a few valid options being developed today, such as Polkadot’s XCM, Cosmos IBC, and a few generalized bridges.

None of these technologies are yet mature enough to rely on, but we aim to closely follow their development and build Zircon Chain on the most convenient solution.

DApp-based decentralized exchanges still have a lot of life in them, don’t worry. But with Zircon Chain, we’ll be able to do things like percentage-based gas fees, encrypted mempool, fast order matching, and many more UX improvements.

Join us in our journey, follow Zircon on Twitter and subscribe to our blog to know first about our updates and improvements.